Prepaid credit card in Germany: Tips and card recommendations

You may be a frequent traveler, an international student or a customer with a bad credit history.. There are many reasons why you may want to apply for a prepaid credit card in Germany, find your next prepaid credit card online or simply compare different prepaid credit cards to be sure to choose the right product for you.

Prepaid credit cards are perfect for people who like easy handling, who would like to have full control over their finances and who need a credit card without a credit check, salary statement and without SCHUFA. They are a good option for students, for travellers or for people who care about their privacy.

We have tested a multitude of prepaid cards and bank accounts that come with free debit or prepaid cards, both from VISA and Mastercard and show you today:

- what a prepaid credit card is

- how to get your prepaid credit card

- which is our best prepaid credit card and

- additional prepaid credit cards that you can compare

Prepaid Credit Cards in Germany: Compare different options to get yours!

A prepaid credit card is popular payment and budgeting method. In Germany more than 8 millions prepaid credit cards are sold every year. Even though its name may sound tricky, a prepaid credit card doesn’t grant you a credit line, like a charge credit card. That is why, when applying for a prepaid credit card you won’t be asked your credit history (SCHUFA).

Prepaid credit cards works like vaults. Once received your card, you have to top it up with the money you want to spend and you will be able to spend exactly that amount. This means that, as in the case of debit cards, your card’s account will get immediately debited with the amount of your purchases. As a rule, you don’t have any overdraft facility, and once you spend all the money in your account, you will have to top it up again.

Due do its practical usage, prepaid credit cards come in handy in different situations. Here we have listed some of the most popular prepaid credit cards in Germany, accordingly to different use cases:

- free prepaid credit cards with online application

- anonymous options, if you want to stay discrete

- prepaid cards with no credit history check (SCHUFA) and

- fee and cost structures of the most popular cards

Prepaid VISA card: A free prepaid credit cards without credit history

- Free bank account with VISA-Card

- 4 account models that can be cancelled at any time

- Free cash withdrawal up to 200€ or 5 cash withdrawals per month

- Disposable virtual credit cards for one-time payments

- Easy exchange of cryptocurrencies and commodities

- Fee-free currency exchange in 30 currencies up to 1000€ per month

Prepaid Mastercard cards: your to go to remain anonymous

- Instant account opening in 3 minutes

- Free account with real-time transactions, debit card

- Instantly generate virtual credit card

- Support in 14 languages, incl. German, Turkish, Romanian, Polish and more

- No address verification or credit check

- International transactions in 19 different currencies

- Open a Checking Account in 5 Minutes with a MasterCard

- Includes a Maestro card, 25 online cards, and the option to open sub-accounts.

- No credit check required for opening.

- Mobile bank with a top app, Google Pay, Apple Pay, and web access.

- Sustainable and environmentally conscious banking.

- Currently offering 3.36% interest on the account with MassInterest.

What is the best prepaid credit card from Mastercard or VISA?

The Black&White Prepaid Mastercard is definitely a good choice because it does not have an annual fee, just an activation fee. You will receive 2 credit cards at the same time and you can use both (Black and White). Since there is no annual fee, the Black&White is pretty good if you’re looking for a prepaid card for long-term use. In addition to the Black&White, the VIABUY prepaid card is a prepaid specialized product.

With more and more neobanks entering the German market, you should consider the option of a free bank account with free debit cards that you can top up. For example Vivid Money or N26 offer free and full bank accounts with a Debit VISA card. They have even more functionalities than your traditional prepaid cards.

Let’s compare the VIABUY Card with the Black&White Prepaid Mastercard and the Vivid Bank account with a free debit credit card:

| Provider | VIABUY | Black&White | Vivid Money |

| One-time activation | 69,90 Euro | 89,90 Euro | 0,- Euro |

| Second prepaid card | Free | Free | Not available |

| Top-up fee (SEPA-transfer) | 0,9% | 1,5% | 0% |

| Yearly fee | 19,90 Euro | 0,- Euro | 0,- Euro |

| Credit history check | No | No | No |

As you can see, Vivid Money might technically not be a prepaid credit card, but it provides you with all the options that you need and does that for free. The reason is that Vivid Money uses a different business model and is mostly focussed on trading stocks and cashback incentives – all prepaid or banking features are free for you.

If you want to stick to traditional prepaid cards, choices from VISA include the payango prepaid credit card (PAYANGO Card and Cristalcard), which comes with a yearly fee of 37,90 Euro. Most VISA cards have gone off the market due to the Wirecard scandal, including mycard2go, mywirecard and PrepaidTrio.

How does a prepaid credit card work?

1. Application process: First, you must apply for the prepaid credit card or technically “purchase” it. The easiest way is to apply for the card online, as the selection is better than with a prepaid credit card from a gas station or kiosk.

2. Top up: Once you have received your prepaid card, you can top up it with money. To do this, you have the option of transferring an amount from any current account, sending it with SEPA transfer, direct debit or going to an ATM and depositing money on the card there. Payment providers such as SOFORT-Überweisung are usually also available.

3. Pay and use: If the credit card is topped-up with money, you can use it online or offline as you would with any other credit card. If you’re using it offline, you will still need a PIN for the card and you should be aware that not all locations accept prepaid credit cards. If you only use the card online, the credit card number and CVV code are enough to pay in stores or on Amazon.

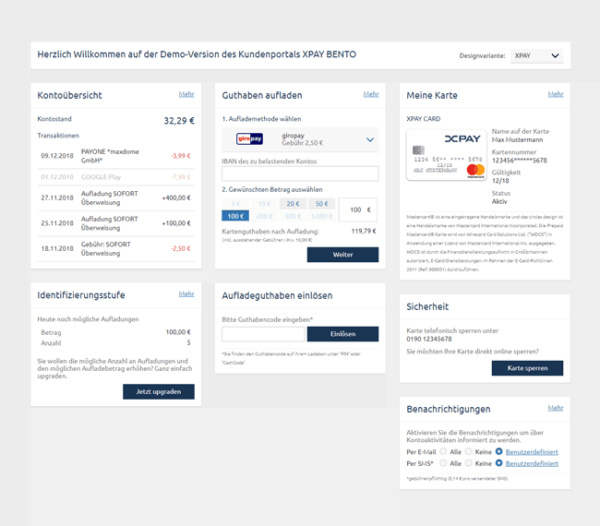

4. Keep track of your spending habits: All good prepaid cards can managed online so that you always have an overview of your card balance, fees as well as usage. An example of the Black&White online banking:

What are the benefits of a prepaid credit card?

Pros

- No credit history required: SCHUFA and creditworthiness are irrelevant as the bank has no credit risk. Prepaid credit cards without SCHUFA are therefore normal.

- Anonymity and security: Neither SCHUFA nor your bank will find out about the prepaid card. You can therefore use the card without the payments appearing on your account statements or your credit history.

- Full cost control: You always have full transparency about your own budget. You can only spend what you pay in.

- Use it like a normal credit card: Withdraw money at home or abroad, shop in stores or pay online – prepaid cards from VISA or Mastercard use the traditional payment networks and are quite versatile.

- Speed: Some providers send the virtual credit card number by email directly after the card has been activated, i.e. in a few minutes.

Cons

- Complicated fee structure: Annual fees, top-up fee, foreign currency costs, inactivity fee etc. etc. Every prepaid provider uses a different model, so when choosing the card you have to pay attention to what you want to use it for or otherwise you might incur high costs.

- No credit limit, just prepaid: It’s called a prepaid credit card, but has nothing to do with credit. You can only spend what you pay in yourself. A real credit card with a credit limit (a revolving card) is a different thing.

- Restrictions for hotels, rentals and for deposit: Not all hotels accept prepaid cards for deposit payments. This also applies to the deposit for a rental car.

- No Google Pay or Apple Pay: If you want to use Google Pay or Apple Pay, you need a prepaid card with a checking account, such as bunq or Vivid Money (both have no credit history check).

What you should know about prepaid credit cards in Germany

Fees and associated costs with a prepaid card

Regardless of whether it is VISA or Mastercard, each issuing card provider has its own fees and cost model. The fees consist of different components that can impact your cost quite a bit. Popular (hidden) fees of prepaid card providers include:

- Initial activation fee when applying

- Annual fee per card

- Top-up fee when transferring or depositing money on the card (usually measured in % of value transferred)

- Fees for cash withdrawals (differentiating between domestic, in the EU and international)

- Foreign currency fee (payment in another currency, includes online payments in USD or CHF for example)

- Inactivity fee (if you don’t use the card, the balance will be “drained”)

When a provider is speaking of a “free prepaid credit card”, he is usually only talking about a yearly fee. The card will nevertheless have fees. The most frequently used fees are the initial activation of the card (in our test between € 29,00 to € 89,00) and a fee when the card is topped up, which depends on the method of deposit selected. SEPA transfers are usually the cheapest, the use of payment service providers such as SOFORT Überweisung, girooay or Paysafecard the most expensive.

Topping-up your card: How can I get money on my prepaid card?

In addition to SEPA transfers, credit-based credit cards can also be topped up by means of deposits, standing orders, top-up credits and via payment service providers. Topping up at an ATM is particularly good for those who like to be anonymous and do not have online banking.

A list of ways in which you can charge or activate the VIABUY:

- SEPA transfer

- Cash deposit at a bank

- SWIFT transfer (international)

- Instant bank transfer

- giropay

- ideal

- eps

- Trustly

- Paysafecard

- Multibanco

- TrustPay

The conditions and minimum/maximum requirements of topping-up the card are also important. Can only a certain minimum and maximum amount be loaded onto the card? If so, is it sufficient for your own needs? This aspect should be taken into account when traveling and longer stays abroad in order not to suddenly find yourself in a foreign country without cash.

Credit card with bad credit: Prepaid cards or bank accounts

If you are looking for a prepaid card to have a VISA or Mastercard due to a bad credit rating or a negative SCHUFA entry or low income, you should take a look at the offers from some new banks and providers. Many of the new providers do not work with SCHUFA and are therefore available even with poor credit ratings. When opening an account, you also receive VISA or Mastercard debit cards, which can be used just like a credit card.

Two of the providers we have highlighted so far are bunq and Vivid Money. Read our in-depth review of bunq here and of Vivid Money here.

Who can get a prepaid credit card

1. You are a minor or do not have your own income

A prepaid card is particularly useful for children and young people who are not eligible to sign up for a proper credit card yet. This way, you will learn to handle money responsibly and you will not be able to get into debt. This payment method is particularly helpful if the youngsters go on excursions or move abroad for a longer period of time, for example for a school or student trip.

Parents have control over the finances and can at the same time inject more money if the account is empty. When applying, you should pay attention to the minimum age, because the access requirements can vary from provider to provider.

2. For students and trainees, or when travelling abroad

A prepaid card might be the best option for students who often do not yet have sufficient regular income. Parents can top up the card regularly, for example during semesters abroad. In advance, however, the costs that can arise when withdrawing cash and making payments in the destination country should be carefully compared.

3. With bad credit, a negative credit history or below average creditworthiness

Since there is no “credit risk” with rechargeable credit cards, you do not have to worry about having bad credit. With with a prepaid card, neither the SCHUFA, Germany’s largest credit bureau, nor other credit agencies such as CRIF or KSV are checked. A salary statement or bank statement is also not necessary. These cards are particularly suitable for people who have a negative SCHUFA entry or who are often refused loans by banks.

This also applies to self-employed and freelancers with irregular income. This irregular income or the classification as “self-employed” can lead to a rejection at many banks. As soon as a wage or salary slip is requested as proof of regular income, access to the conventional credit card is usually denied.

4. For reasons of anonymity and data protection

A prepaid card is not linked to any bank account, bank statement or credit agency. That’s why a prepaid card makes sense if you want to protect your data and all of your payment streams being combined. With a prepaid card, you can pay in cash at an ATM and do not have to link another account.

This way, you can have a credit card for online payments that you can use for services you might not want to be seen on your main bank statement, such as crypto, gaming, occasional gambling or other services that you do not want to be known by your bank.

FAQ: Prepaid credit cards and top-up cards

Yes. Prepaid cards are actually always available without a credit history check and without proof of creditworthiness. You will also not need to upload a bank statement or payslip. The reason is that the bank has no “credit risk” and will charge you for the use of the card.

Examples of cards that have no requirements are the Black&White Mastercards or the VIABUY Prepaid Card.

Depending on the card selected, there is a one-time activation fee and / or an annual fee that is due for traditional prepaid cards. These are usually to be paid directly when applying by loading money onto your card. The costs in our tests from VIABUY and Black&White are between € 19,90 – € 89,90. Depending on the provider, there are different fees for topping-up, using or, for example, withdrawing money from the machine.

There are several types of people who could really use a prepaid card.

1) Pupils, students or minors who do not have a main account,

2) people with a bad credit rating or negative SCHUFA who need a credit card,

3) cost-conscious people who have a good overview of their finances

4) data-privacy and anonymity-conscious consumers who do not want to have all payments in their payroll account.

Applying for a prepaid card only takes a few minutes. Since you are applying for a credit card, you have to do a quick identification check. If you opt for a physical card such as Black&White or VIABUY, it will take up to 2 or 3 working days for the prepaid card to arrive in the mailbox by post.

If you do not want to wait, you should check providers of virtual credit cards. With these, the credit card number is sent directly by email. The application up to the exhibition only takes a few minutes. One of these providers is, for example, KREDU.

The maximum limits are between 4.500,- Euro and 50.000,- Euro, depending on the card. Normally you don’t have to worry about the limits. The highest limits are usually for SEPA transfers. With some payment methods, the top-ups per process and per day are limited to around 500,- Euro to 1.000,- Euro.

The limit for cash at the machine is between 500,- Euro and 2.400,- Euro per day and per week. This is above average when compared to normal debit cards from large banks such as DKB Bank or Commerzbank AG.

Although the term “credit” is in “credit card”, a prepaid card does not give credit. The term “credit card” goes back mainly to the use of the large credit card networks of VISA, Mastercard or American Express.

Prepaid cards are therefore much more similar to a debit card in their way. We explained how a debit card works and how to get one in our debit card guide.

Did you find this page useful and want to leave a feedback? Have you already applied for a prepaid credit card and want to share your experience with us? Leave a comment, we look forward to reading your opinions!

I take it!