Revolut Ultra Reviews: Testing the Premium Account with an Exclusive Platinum Debit Card

After the successful launch of Revolut Standard, Plus, Premium, and Metal, the British neobank announced in April 2023 its new subscription model: Revolut Ultra, aimed at luxury lovers, premium clients, and globetrotters willing to drop 50€ on a current account with a platinum debit card.

Having tested all the other account models and shared our thoughts in a review, we decided to subscribe to Revolut Ultra. We’ve been testing Revolut’s Ultra bank account for six months, and today we’re spilling the beans on whether the Ultra subscription is worth it.

In this article, you’ll find:

- A rundown of Revolut Ultra’s perks, including screenshots and examples.

- The pros and cons of Revolut’s luxe current account.

- Our experiences with Revolut Ultra, including ratings.

- Some cheaper alternatives to the famous British FinTech. Revolut Ultra put to the test

Disclaimer: Since our service is dedicated to English speaking customers living in Germany, we have tested the Ultra’s benefits in Germany. There may be variations using the service in a different country.

What’s Revolut Ultra? A full scoop on all the perks, fees, and services of Revolut’s luxury checking account

Revolut Ultra is the British FinTech’s luxury subscription, aiming to reach an even wider customer group. Announced in May 2023 and available since June, the subscription model offers up to 1% cashback, makes travel easier with VIP lounge access and free subscriptions with Revolut partners, among other perks that have won us over.

But, what’s the price tag for joining Revolut’s VIP world?

Below, you’ll find the features of the Ultra subscription.

How does Revolut Ultra stack up? A look at what the luxury subscription offers compared to other Revolut accounts

At first glance, the Ultra subscription doesn’t seem to offer much more than other account models. However, the devil’s in the details. Unlimited international payments and no-fee currency exchanges, along with a suite of traveler benefits, make the Ultra account particularly alluring for those who travel often. We’ll break down these benefits and whether it’s worth forking out 50€ a month in the next section.

A Platinum Card with Cashback for World Travelers

The first perk you enjoy right after opening a Revolut Ultra account is the platinum Mastercard debit card. Even though purchases with the card are charged directly from your account, at least it’s done with panache. We’ve heard an impressed “WOW” in stores several times when we whip out our sleek card.

Beyond the card’s look, we’re especially thrilled about the cashback: 0.1% in Europe and 1% abroad, an attractive offer that can benefit both world travelers and locals. Plus, if you set up your Revolut card as the primary payment method on Apple Pay or Google Pay, you can also comfortably earn cashback on app subscriptions or online shopping.

Very much insurance

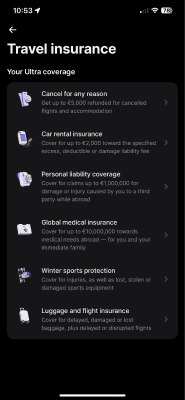

Revolut Ultra offers a comprehensive insurance package. The insurance services are backed by two agents: Qover S.A., a Belgian company, and Cowen Insurance Company Limited, a Maltese company managed by Cover Genius Europe B.V.

In a nutshell, the next is what Revolut Ultra’s insurance covers (we have included the insurance premiums for customers living in Germany).

Travel insurance:

- 100% reimbursement for non-refundable trips in case of cancellation due to health issues (also for companions), change of residence or workplace, travel provider issues, identity theft, or adoption procedures.

- For unexpected damages to a rental car, Revolut covers up to 2,000€ of your deductible.

- Protection for luggage and in the event of delayed luggage delivery.

- Worldwide medical insurance up to 10,000,000€ for you and a family member, including emergency dental treatments.

Day-to-day insurance:

- Private liability insurance up to 1 million euros for damages to third parties.

- Winter sports insurance for injuries, theft, or damage to winter sports equipment up to 1,500€.

- Reimbursement of up to 1,000€ for canceled events (100% or 70% refund).

- Purchase protection up to 10,000€ for repair or theft within 12 months of purchase or up to 300€ for non-accepted item return.

Free Premium Subscriptions with Revolut’s Premium Partners

With Revolut Ultra, you score a bunch of free premium subscriptions from various providers. It’s a bit fuzzy who Revolut’s aiming at: Digital Nomads or high-spending singles? With three free passes to WeWork, a digital subscription to Financial Times, and a Tinder Gold membership, it looks like Ultra’s client focus is both work and play.

We think the mix of partnerships could be more thoughtful. It’s tough to see a customer using all the offered subscriptions. But, if you were to shell out for each separately, you’d be down over 150€ a month… Revolut Ultra can definitely save you some cash!

Here’s the breakdown of each Ultra membership if bought solo.

How does Revolut profit from memberships? That’s the top question we hear from our customers. Sure, Revolut doesn’t make an immediate profit off each individual partnership. Instead, the gain lies in an all-inclusive business model encompassing all FinTech services.

However, one could guess not every customer uses every perk (meaning Revolut doesn’t have to shell out extra on some clients) and the sweet deals Revolut has with its partners may include different terms (often more favorable) than what an individual customer would get.

Pros and Cons of Revolut Ultra Subscription

Pros

- Fancy debit card for Premium clients: The platinum Mastercard World Elite is a step above the VISA Infinite from the Metal subscription and is a solid addition to your wallet.

- Real cashback on every spend: Whether you’re paying with Apple Pay or Google Pay, in stores or online, you always get 0.1% cashback in Europe.

- Travel like royalty: With Ultra you get into the top-known airport VIP lounges, comprehensive travel insurance, and rental car protection—definitely a global traveler’s dream.

- Clear app with priority customer service: Need anything? There’s a chat right in the app for Ultra customers or you can easily request a callback.

- Cool range of partner subscriptions: Fitness, information, work, and love—all covered with Revolut’s premium memberships.

Cons

- Debit card instead of credit: The platinum Mastercard is top-notch but doesn’t offer credit—if you need borrowing power, you’ve got to use your overdraft or take out a personal loan.

- No concierge service: Unlike other luxe cards (like Amex Platinum), you don’t get a concierge to handle the day’s yawns for you.

- Not quite luxury-focused: Revolut tries to cover a bit of everything (travel, shopping, investments) but isn’t yet the cream of the crop in any.

- No points or bonus program: Revolut has cashback deals but lacks a points program for snagging discounts or upgrades.

How does Revolut stack up against other neobanks? Any alternatives to the British FinTech’s Ultra subscription?

With a Revolut Ultra subscription, you snag the exclusive Revolut Platinum Mastercard. Still a mystery if Revolut’s diving into the luxe sector of those famed Platinum credit cards.

The Revolut Platinum debit card dishes out travel perks, an insurance pack, and premium subscriptions with selected partners. Can Revolut hold its own against other famed Platinum credit cards?

That’s what we’ll see next.

Our final take on the Ultra subscription: Interesting but with room to grow

The cashback, VIP lounge access, and our digital Financial Times subscription are the real deal-breakers. Revolut Ultra is crafted for folks who are frequent flyers and prioritize mobile experiences. It could even be a solid pick for freelancers and Digital Nomads living that flexible lifestyle.

Ultra’s worth it if you’re city-based

But, it’s worth noting, to really milk Revolut Ultra’s perks, best be in a big city. Like in Padua, Italy, we couldn’t use our ClassPass credits—no local partners.

Traveling with Revolut isn’t “ultra” luxe

As earlier mentioned, even though Revolut offers a broad spectrum of services, it’s not king of the hill in any. VIP lounge access is limited to certain lounges, just like the availability of partner services. Plus, with Revolut, you don’t rack up bonus points for stays at famous hotel chains like Mélia or Marriott (unlike, say, with Amex Platinum).

Revolut Ultra is a catch for those ready to dip into luxury

Math-wise, the monthly value of Revolut’s premium subscriptions hits 199.24€, making the 50€ monthly fee look pretty sweet. But, we recommend a good think on how much you’ll really use the different benefits. Say, if you already have travel insurance and always fly Business, you might not score much extra from the Ultra membership.

So, we reckon Revolut Ultra’s especially neat for those tiptoeing into luxury, but not quite sure if it’s their jam.

What is the company behind Revolut?

| Company name | Revolut Limited |

| Company type | Fintech |

| Address | 4th Floor, 7 Westferry Circus, E14 4HD London, Großbritannien |

| Website | revolut.com/en-DE |

| feedback@revolut.com | |

| Phone | +442033228352 |

| Not available | |

| Hours | Monday - Sunday 24hrs (Live Chat) |

| Social Media |

Instagram |

| English support | No |

FAQs about Revolut Ultra’s subscription

No. The platinum Mastercard from the Revolut Ultra subscription is a debit card. This means that each time you make a purchase, the amount is deducted directly from your account, as Revolut does not assign you a credit frame.

If you’re looking for a credit product, you can apply for a personal loan up to 50,000€ with Revolut.

Revolut Ultra is a premium account with a platinum debit card aimed at customers who lead a luxurious lifestyle and travel frequently. Key benefits include up to 1% cashback, unlimited commission-free currency exchange, access to airport VIP lounges, and extensive insurance packages. For 50€ a month, Ultra also offers a range of premium partnerships with selected partners like WeWork and Financial Times.

With the Revolut Ultra debit card, you get 0.1% cashback on purchases within Europe and 1% on purchases abroad. This offer applies to all transactions, including using your card through Apple Pay or Google Pay. Cashback is also awarded for online purchases and app subscriptions, provided the Revolut card is set as the primary payment method.

Revolut Ltd. is the original FinTech with which Revolut acquired an electronic money license. In the EU, Revolut Bank UAB offers services from the different account models.

This is a serious European bank, approved by the European Central Bank and supervised by the Bank of Lithuania. For detailed information about Revolut, you can read our general review of Revolut.