Credit card vs debit card: Useful information to chose the best offer

With currently over 110 million debit cards, these are more popular in Germany than ever before and at the same time exceed the number of credit cards. Debit cards are payment cards tied to a bank account. When coming to Germany, you may want to pay contactless or online without worries, that is why you may want to get a German debit card.

In this article we will show to you:

- what is a debit card

- how debit cards work

- the main difference between debit and credit cards

- Germany’s best VISA debit card (tied to a bank account) and virtual debit card

GIROMATCH.com regularly tests for you different financial products and tell you its impressions. Find more in our reviews’ collection.

What is a debit card? Key fact about this payment method

In Germany, the term debit card is often equated with “EC card”, “bank card” or “girocard”. Basically, all these terms mean the same: a payment card that is linked to a current account at a bank, for example. It differs from a credit card in many ways. With a debit card you can make cashless payments in stores or withdraw money from ATMs.

- Debit card is a payment card tied to a checking account

- It can be used to pay or withdraw money

- The money is withdrawn directly from the bank account, which must be covered at the time (or if necessary you should have an overdraft facility)

- Often called EC card, bank card or girocard

- Many banks offer virtual debit cards in addition to your physical one

Credit card vs debit card: Which one you should use

Outwardly, debit cards and credit cards hardly differ, but these are two completely different types of card. The biggest difference is the time of debit: if you pay with a debit card, the corresponding amount will be debited directly from the amount of money available on your checking account. With a credit card, on the other hand, you take out a small “loan”, i.e. the money does not have to be available in your account, but is either billed to you in full at the end of the month, or you only have to pay it back partially. In return, you pay interest on the credit card.

This makes credit cards dependent on your creditworthiness. Their limit depends on your credit score, since the card’s provider has to be sure that you are able to pay your credit back. On the other side, debit cards are part of a bank account, which everyone has right to open.

With regard to payment or withdrawals abroad, you can run into problems with the debit card, which is why credit cards have some advantages here. Credit cards can also be used outside of the EU without any problems, as VISA, Mastercard or American Express payment centers are used all over the world. V-PAY from VISA, on the other hand, is primarily to be found in Europe.

What is meant by the debit card number?

When looking at the debit card number, one have to make a distinction between debit cards and debit credit cards. The first pertains usually to Maestro or V-Pay system, are directly linked to your bank account and usually issued immediately after having opened a bank account in Germany. Debit cards do not have a debit card number but only display the IBAN and a BIC that belongs to the issuing bank, therefore, you cannot pay online with a plain debit card.

The IBAN represents the International Bank Account Number, which is a 22-digit combination. In the foremost two places, this gives information about the country code (for example: “DE” for Germany). This is followed by a two-digit check digit, before this in turn is followed by your 8-digit bank code and your 10-digit account number. The BIC is the bank identifier code, which is made up of the bank identifier, the country code as well as the regional location and the branch identifier.

Many mobile banks issue VISA or Mastercard debit credit cards nowadays. These are debit credit cards, i.e. they have a debit card number similar to the credit cards‘ one and enable you to pay online. The debit card number is composed as following:

- the credit card number: a 12-16 digit number on the front of your debit card

- its expiration date

- the Card Verification Value (CVV) or Card Verification Code (CVC): also known as the security code on your debit card

- a PIN for ATM cash withdrawals or purchases in retail stores

Which is the best German debit card?

Since debit cards are tied to a bank account, you will have to apply for a debit card at your home bank. When looking for the best German debit card, you will have to keep in mind the bank account’s features, as your card is not issued independently. Here you will find a list of our recommendations for different use cases:

- a virtual debit card that you can use in Germany or everywhere

- a German debit card with a German bank account and overdraft facility

- the best debit card for kids and travelers in Germany

In general, if you wish to purchase online and keep an eye on your expenses, we advise you to look at the debit cards offered by mobile banks: the majority pertain to the VISA or Mastercard systems and display a number and a security code on the debit card, which make it possibile to pay online.

Monese: The peace-of-mind debit card and multiple virtual debit card for your online shopping

- Instant account opening in 3 minutes

- Free account with real-time transactions, debit card

- Instantly generate virtual credit card

- Support in 14 languages, incl. German, Turkish, Romanian, Polish and more

- No address verification or credit check

- International transactions in 19 different currencies

DKB: Free German bank account with free debit card and overdraft facility

- No account management fees

- Free debit card and DKB VISA card

- Withdraw money abroad free of charge

- Modern app, online banking, contactless payment, Apple Pay, Google Pay

Revolut: best debit card for kids and globetrotters

- Free bank account with VISA-Card

- 4 account models that can be cancelled at any time

- Free cash withdrawal up to 200€ or 5 cash withdrawals per month

- Disposable virtual credit cards for one-time payments

- Easy exchange of cryptocurrencies and commodities

- Fee-free currency exchange in 30 currencies up to 1000€ per month

How does a debit card work?

If you would like to use your debit card for cashless payments as well as for withdrawing money from an ATM, all you have to do is insert your card into the corresponding card reader or into the ATM. In the following, you will be asked to enter your PIN. This is your personal identification number or PIN, which you can use to authorize any payment or debit from your current account.

Your PIN usually consists of a four-digit number combination. Depending on the payment method, payment by signature is also possible in retail, which means that the PIN is no longer required.

When using the debit card, the amount is debited directly from your account. Thus, you need a connected account with sufficient funds to use of a debit card. This applies to both cash withdrawals and transactions at the point of sale (i.e. in retail).

Information on your physical debit card

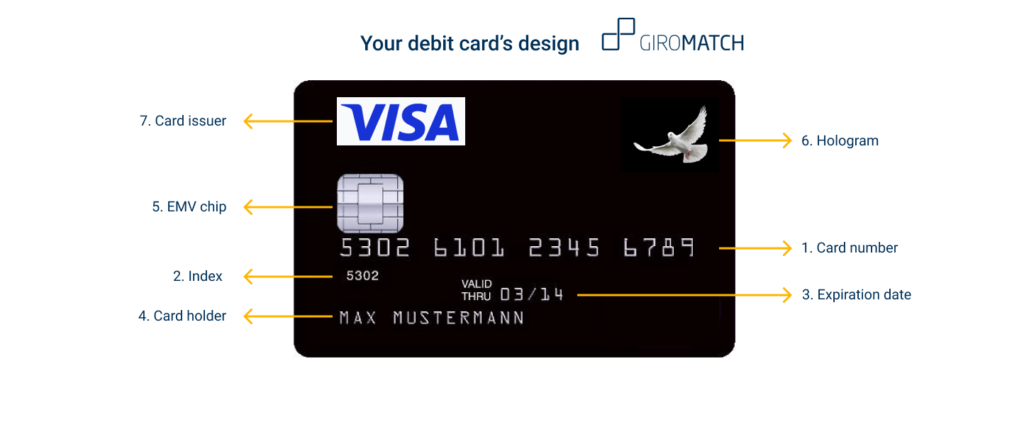

Your debit card contains important information in order to identify the bank account which it is tied to. Physical debit card are made of special PVC and present 7 important elements.

- The debit card number of the debit card. In Germany this is usually the IBAN, which begins with “DE” and is then supplemented by a check digit, bank code and account number

- The index: it is composed by the first four digits of your BIN code

- The expiration date in the MM / YY format. The validity of debit cards is usually between 2 and 5 years

- The name of the cardholder, possibly with special embossing.

- The EMV chip (“Chip and PIN”) of your account. EMV stands for Europay International, MasterCard and VISA and is a specification for payment cards that can be used at POS terminals or ATMs. Europay, MasterCard and VISA developed the EMV card and are therefore named after it.

- The hologram as a security feature of the card

- The logo of the bank or credit institution with which your account is held with the debit card

Girocard vs debit card: What is an EC card or girocard?

The current system of the debit card was still implemented by the Eurocheque system until 2002. This is considered to be the predecessor system, which was introduced in the 1960s. The first EC cards – i.e. Eurocheque cards – were then supplemented over the course of time by the functions of the debit card. With the Eurocheque system, on the other hand, a guarantee contract between the banker and the check taker ensured that the corresponding check could actually be paid out.

In terms of structure, however, the Eurocheques were also plastic cards, with which various payment services were made possible at credit institutions. In addition to the possibility of withdrawing money and paying in Germany, the Eurocheque system was also the first cross-border payment system in Europe. In the end, 49 active and passive countries accepted the Eurocheque cards as a payment option.

Here you can find information about the different types of debit system:

FAQs about debit cards

Banks usually issue debit cards free of charge when opening a checking account. You can then use this to pay, shop or withdraw money. There are usually no ongoing charges, but this may vary from bank to bank.

The issue of a debit card is a regular term from the banking world, which means that the bank issues you a debit card in addition to the bank card (Girocard or EC card). For example, comdirect has turned the tables and issues the girocard as an option, whereas the issue of the debit card (a Mastercard) is mandatory.

Debit cards are replacing giro cards more and more, as they are better connected to the payment network of the major payment service providers such as VISA and Mastercard. This makes it easier to withdraw money abroad, for example, as payment systems such as girocard are not accepted abroad.

With the introduction of contactless payments via Google Pay, Apple Pay or Samsung Pay, debit cards have become even more useful, since debit cards from Mastercard and VISA can be used for Google Pay. This applies, for example, to Commerzbank, DKB, comdirect, but also many other banks.

Strictly speaking not. With a debit card that is linked to your current account, you have all the functions of a current card at your disposal. Whether withdrawing money, paying in stores, shopping online or using the contactless payment function: Debit cards offer all of these functions.

Not always. The payment transactions with a debit card are immediately debited from the account. However, it is quite possible that the bank will set up a credit line for you on your account. The DKB VISA debit card, for example, automatically comes with a € 500 limit on the card, so that you can overdraw the account up to five hundred euros.

Debit and credit cards may look the same. However, the major difference lies in the point in time when your purchases will be debited: credit cards grant you a credit line (with the duration of one months) and the amount of your expenses is debited at the end of the checking period. On the contrary, debit cards are bound to your bank account and your expenses will be immediately debited in the moment when you use your card.

Further differences consists in the costs of the cards and the creditworthiness required to apply for a card. You can read more on our dedicated section.

There are many pages where you can generate free credit card numbers for your online trials. As a rule, if you want to test a product to see how the application process work (e.g. if you apply for a loan or a service delivered online) you can introduce fake debit card numbers. However, you will neither be able to actually purchase the service or buy something online, since fake debit cards are recognized and do not pass the validity check of online providers.

Did you find this page useful and want to leave a feedback? Have you already a German debit card and want to share your experience with us? Leave a comment, we look forward to reading your opinions!