Free bank account in Germany: Available accounts, comparison and rating of the bank account without fees

Moving to Germany is often a stressful bureaucratic travel along German rules and prescriptions. Fortunately, opening a free bank account has become easier and easier in the last times! Many mobile and online banks have started to offer free bank accounts for expats or foreigners in Germany which you can open online in less than 30 minutes.

In our guide on German best banks, we have shown you neobanks and traditional banks and have focused on a broad products’ offer. Instead, in this page, we will show to you:

- 7 German bank accounts free of fees forever

- The best free bank account for expats according to our experts

- Some pieces of advice to choose your free bank account

- A comprehensive list of features that you will find in a free bank account in Germany

Free bank account in Germany: Comparison of 7 German bank accounts without fees

Best free bank account in Germany: Revolut Standard Account

Vivid Money and Revolut are contending the title of best free bank account in Germany. With both account you can open a completely free bank account which speaks your language. You can enjoy all basic functions of a bank account (withdrawals, debit card payments and pockets). Additionally, you can open sub accounts in different currencies to be able to transfer money home.

However, Vivid will charge you a little fee for inactivity. This means that if you do not use actively your account, you may pay 3,90€/month for it. Instead, Revolut grants you a complete free bank account. In addition, following its rapid expansion and improvement, there are reasons to believe that Revolut may add new features as personal loans or credit cards in the short run.

- Free bank account with VISA-Card

- 4 account models that can be cancelled at any time

- Free cash withdrawal up to 200€ or 5 cash withdrawals per month

- Disposable virtual credit cards for one-time payments

- Easy exchange of cryptocurrencies and commodities

- Fee-free currency exchange in 30 currencies up to 1000€ per month

What is important when choosing your free bank account in Germany?

There are many banks, even more traditional ones, which offer free bank accounts in Germany. As a rule, if you are a student, you will be granted free benefits until graduation! However, many free accounts are not completely free as they come with some additional requirements or with hidden costs. Take a look at the following points to find the free bank account for your needs:

Monthly deposit

- Is a minimum monthly deposit required? Many banks. such as DKB, requires a minimum entry (salary, retirement or similar) of about 500€ to 700€ for your bank account to be completely free.

Specific status

- Is the free price forever or only as you have a specific status, e.g. you are a student? Many German banks, such as Deutsche Bank, provide you with a range of benefits when you are a student but once you forget to prove that or you step into your career, you will have to pay for them.

Debit or credit card

- Is there an annual fee for a debit card or credit card? If yes, you can have a look on our guide on the best German free credit cards.

Cash withdrawals

- Are cash withdrawals free of charge? Are there limits on the number of cash withdrawals?

- At which ATMs can you withdraw cash free of charge? Often German banks only allow to withdraw money free of charge in ATMs of their own banks’ group.

Online banking

- Is the use of online banking free of charge? Are there fees for transfers or standing orders? Remember that in Germany electricity, hot water and heat supply are usually paid through standing orders

Free multi-currency bank account: Which options are available for expats and digital nomads

If you have already moved to Germany but still handle money in different currencies to send home or receive international payments, having a free multi-currency account will be an advantage. Besides, if you are an expat or a digital nomad, a multi-currency account will allow you to act as a local even when you are travelling.

Whenever you need to handle foreign currencies, you can think about 4 main necessities: holding, spending, sending and receiving the foreign money. Unfortunately, the most German traditional banks such as Commerzbank or Deutsche Bank charge additional fees for some (or all) of these activities.

But we have good news! Neobanks such as Revolut and Vivid Money, offers free basic bank accounts for expats and internationals and nice possibilities to handle money in foreign currencies.

Before diving deep into the differences between some free multi-currency bank accounts, we thought that it may come in handy to have a list with the eventual fees that you may have to pay:

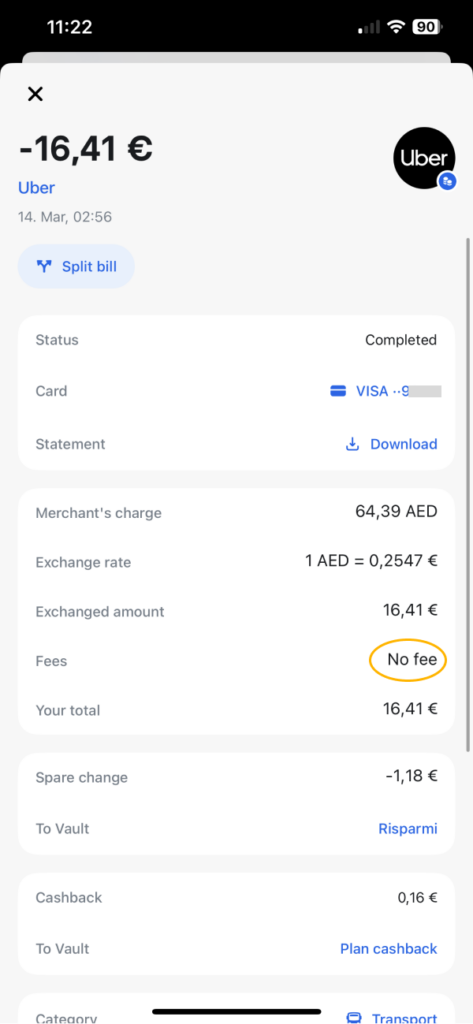

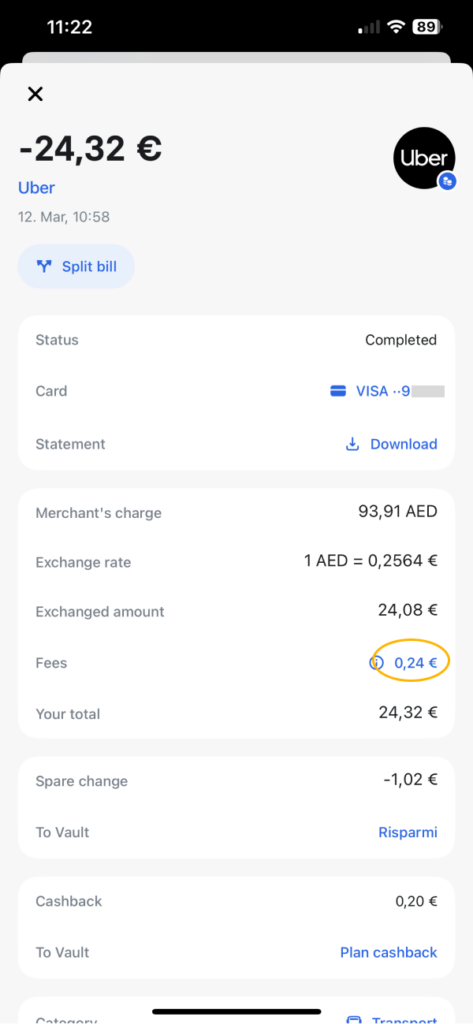

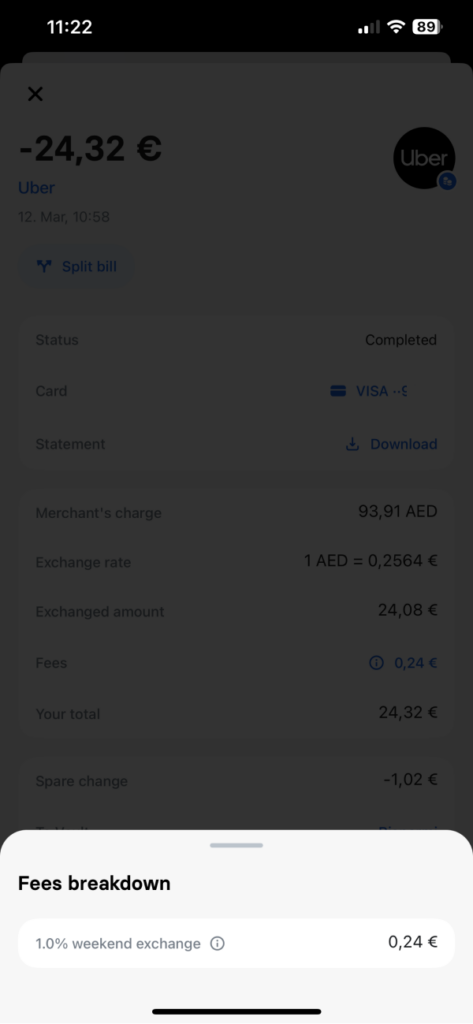

Unfortunately, when visiting Dubai we did not recall about weekend’s markup on foreign currencies…

Comparison of Revolut vs. Vivid Money vs. Monese: Which is the best free multi-currency bank account that you can open in Germany?

When it comes to fees for holding a multi-currency account, the three competitors do not differ that much. Revolut offers a slightly better fees’ structure as you do not have to pay for receiving money in a foreign currency and you can pay up to 1.000,-€ in a foreign currency without paying any fee. Both are surely a good option for expats as they all come with the possibility of opening different sub-accounts in different currencies.

We also have tested the three neobanks and you can find our detailed review on the following pages: Revolut, Vivid Money, Monese.

Banking like a local but acting like a global: Which options do you have with a free bank account in Germany

Besides looking up the fees that you have to pay to handle foreign currencies, you may want to consider the idea of opening a sub account with the IBAN of your home country to be able to run basic services also there. In this case, you will have a powerful multi-currency account. The advantages are:

- Easier Transactions: Having a local IBAN can make it easier to send and receive payments within the same country or economic area.

- Lower Costs: When you have a local IBAN, you can often avoid international transfer fees or foreign transaction fees that might apply when sending money to or from a foreign bank account.

- Faster Transfers: Payments between accounts with local IBANs can often be processed more quickly than international transfers.

- Local Compliance: In some cases, having a local IBAN can help meet local business requirements. For example, some businesses or government entities may prefer or require a local bank account for direct debits, deposits, or payroll.

However, we do not know any free multi-currency account in this sense. Bunq, a neobank which offer a Standard bank account for 2,99€/month, allows you to open a sub-account with international IBANs (NL, FR, DE, IE, ES). Unfortunately, we could not find any information about Vivid’s offer. For sure, they offer bank accounts with German, Spanish or Italian IBANs and the possibility to open sub-account with up to 40 currencies (in the free version). However, it seems that these sub-accounts will still have an IBAN from the home country of your main account.

FAQs on free bank accounts in Germany

Comparing different bank accounts, we have considered Revolut as the best free bank account in Germany as of June 2023. However, choosing a bank account should be done properly and individually. In this table you will find our detailed comparison of 7 free bank accounts.

With a multi-currency account you can buy, hold, spend and send money in different currencies whenever you want. In general, you will find the possibility to open a multi-currency account at every traditional German bank, but this would not always be free of costs. Revolut, Vivid Money and Monese offer you a free multi-currency bank account when you can hold money in up to 150 different currencies.

Many banks, such as DKB, Revolut, Vivid Money and C24 Bank are currently offering bonuses for referring friends or opening a bank account after having been referred. In general, new banks are keen to get new customers and may boost their sales by offering money or presents for the new joiners. In our comparison you will find 6 banks that have such program!

In our guide, we have explained in detail how to open a bank account in Germany. In sum, you may choose to open your account online or offline by going to a bank branch. Opening a bank account online is as easy as 1-2-3 and you will only need to follow the following steps:

- Fill a form with your personal detail

- Go through the identification process which may be a video call, a selfie or a connection to your online bank

- Update your address to obtain your physical card

VISA Girocard, VISA Debit

VISA Girocard, VISA Debit Mastercard Debit

Mastercard Debit